How Do Mutual Funds Increase In Value

Obfuscation in Mutual Funds

- deHaan, Son, Xie and Zhu

- Journal of Accounting and Economic science, 2022

- A version of this newspaper tin exist found hither

- Want to read our summaries of academic finance papers? Check out our Bookish Research Insight category

What are the Inquiry Questions?

According to the Investment Company Institute, mutual funds traded on US Exchanges comprise 58% of investors' retirement savings. However, despite their popularity, at that place is aplenty prove that they underperform their market benchmarks (1) , and are usually taxation-inefficient compared to ETF's. The underperformance, at least in function, is due to overly complex disclosures and fee structures that make it hard to sympathize and compare funds. Carlin (2009) suggests that complexity persists because information technology is part of a strategy to obfuscate unfavorable information and extract rents from retail investors. The authors of this newspaper ask the following questions:

- Exercise mutual funds create unnecessarily complex disclosures and fee structures to obfuscate weak net performance?

What are the Academic Insights?

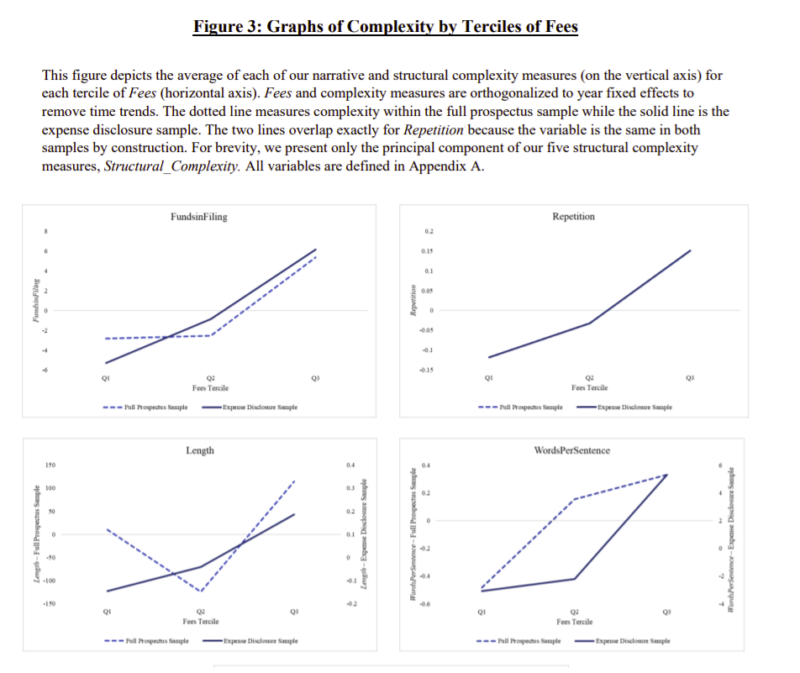

The authors written report the narrative complication of 38 S&P 500 alphabetize mutual funds prospectuses from 1994 to 2022 past developing iv measures of readability ( number of funds included in the prospectus, the repetition betwixt the summary section and the rest of the prospectus, the length of the certificate equally number of words, and finally the writing clarity) as well as the structural complexity (two) . The authors notice:

- Aye, there is strong and positive associations between fees and multiple measures of both narrative complexity and structural complexity. The authors discover evidence that high fee funds have more circuitous disclosures and fee-structures than low fee funds.

The authors bear a number of robustness checks to exclude that narrative complexity is a non-discretionary byproduct of an omitted variable or irrelevant to investors.

The authors comment that their findings do not necessarily hateful that managers consciously create complication to obfuscate high fees. Notwithstanding, fifty-fifty if managers do not understand the effects of complexity, the findings betoken that loftier-fee funds have not embraced the SEC's efforts to reduce complexity in fund disclosures.

Why does it matter?

This paper is important because it contributes to the literature investigating why retail investors brand poor mutual fund choices.

The Almost Of import Chart from the Paper:

Abstract

Mutual funds concord 32% of the U.S. equity market and contain 58% of retirement savings, yet retail investors consistently make poor choices when selecting funds. Theory suggests that poor choices are partially due to mutual fund managers creating unnecessarily complex disclosures and fee structures to keep investors uninformed and obfuscate poor functioning. An empirical challenge in investigating this "strategic obfuscation" theory is isolating manipulated complexity from complication arising from inherent differences across funds. We examine obfuscation amid S&P 500 index funds, which have largely the same regulations, risks, and gross returns only can accuse widely different fees. Using bespoke measures of complexity designed for mutual funds, we notice testify consistent with funds attempting to obfuscate high fees. Our report improves our agreement of why investors brand poor common fund choices, and of how price dispersion persists among homogeneous index funds. We also discuss insights for mutual fund regulation and the bookish literature on corporate disclosures.

Learn Something? Share the Noesis!

How Do Mutual Funds Increase In Value,

Source: https://alphaarchitect.com/2021/12/22/do-mutual-funds-increase-disclosure-complexity-to-hide-fees/

Posted by: rosswharry.blogspot.com

0 Response to "How Do Mutual Funds Increase In Value"

Post a Comment